By showing the total direct labor variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. The actual rate can differ from the standard or expected rate because of supply and demand of the workers, increased labor costs due to economic changes or union contracts, or the ability to hire employees at a different skill level. Direct labor rate variance determines the performance of human resource department in negotiating lower wage rates with employees and labor unions. A positive value of direct labor rate variance is achieved when standard direct labor rate exceeds actual direct labor rate.

How to Calculate Direct Labor Variances

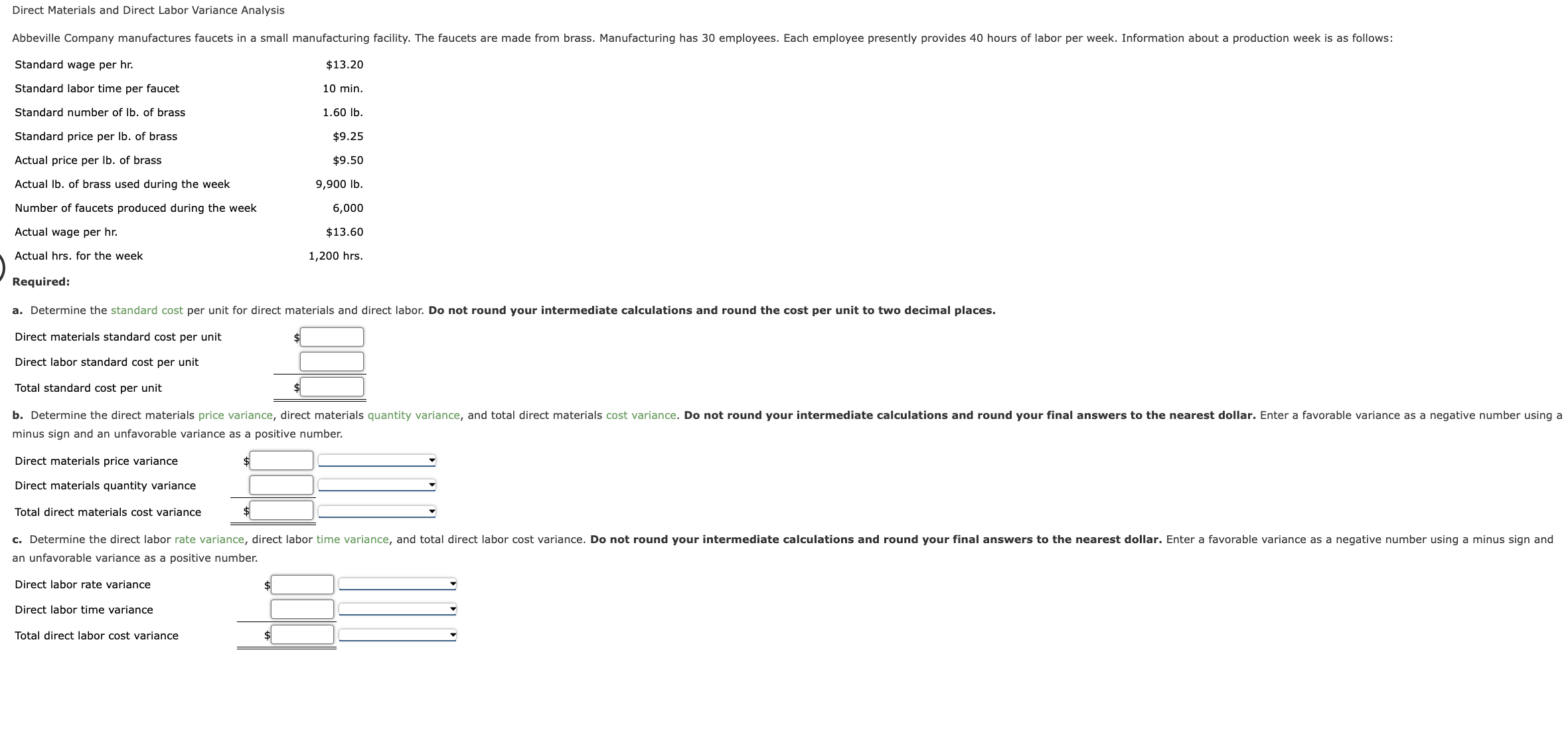

Next, we calculate andanalyze variable manufacturing overhead cost variances. When a company makes a product and compares the actual labor cost to the standard labor cost, the result is the total direct labor variance. When a company makes a product and compares the actual labor cost to the standard labor cost, the result is the total direct labor variance. To estimate how the combination of wages and hours affects total costs, compute the total direct labor variance. As with direct materials, the price and quantity variances add up to the total direct labor variance. United Airlines asked abankruptcy court to allow a one-time 4 percent pay cut for pilots,flight attendants, mechanics, flight controllers, and ticketagents.

How do you calculate labor yield variances?

This will result in an unfavorable labor rate variance, since the actual hourly rate of pay will exceed the standard rate specified for the particular task. In contrast, a favorable rate variance would result when workers who are paid at a rate lower than specified in the standard are assigned to the task. Finally, overtime work at premium rates can be reason of an unfavorable labor price variance if the overtime premium is charged to the labor account. Direct labor rate variance (also called direct labor price or spending variance) is the difference between the total cost of direct labor at standard cost (i.e. direct labor hours at standard rate) and the actual direct labor cost. Standard costs are used to establish theflexible budget for direct labor. The flexible budget is comparedto actual costs, and the difference is shown in the form of twovariances.

- If the tasks that are not so complicated are assigned to very experienced workers, an unfavorable labor rate variance may be the result.

- Skill workers with high hourly rates of pay may be given duties that require little skill and call for low hourly rates of pay.

- The standard time to manufacture a product at Hitech is 2.5 direct labor hours.

- If workers manufacture a certain number of units in an amount of time that is less than the amount of time allowed by standards for that number of units, the variance is known as favorable direct labor efficiency variance.

Direct labor efficiency variance

Figure 10.43 shows the connection between the direct labor rate variance and direct labor time variance to total direct labor variance. The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor. According to the total direct labor variance, direct labor costs were $1,200 lower than expected, a favorable variance. As with direct materials variances, all positive variances areunfavorable, and all negative variances are favorable. If customer orders for a product are not enough to keep the workers busy, the production managers will have to either build up excessive inventories or accept an unfavorable labor efficiency variance.

As a result of this unfavorable outcome information, the company may consider using cheaper labor, changing the production process to be more efficient, or increasing prices to cover labor costs. Direct labor rate variance is equal to the difference between actual hourly rate and standard hourly rate multiplied by the actual hours worked during the period. The variance would be favorable if the actual direct labor cost is less than the standard direct labor cost allowed for actual hours worked by direct labor workers during the period concerned. Conversely, it would be unfavorable if the actual direct labor cost is more than the standard direct labor cost allowed for actual hours worked. Skill workers with high hourly rates of pay may be given duties that require little skill and call for low hourly rates of pay.

If direct materials is the cause of adverse variance, then purchase manager should bear the responsibility for his negligence in acquiring the right materials for his factory. For Jerry’s Ice Cream, the standard allows for 0.10labor hours per unit of production. Thus the 21,000 standard hours(SH) is 0.10 hours per unit × 210,000 units produced. Calculate the labor rate variance, labor time variance, and total labor variance.

In this question, the Bright Company has experienced a favorable labor rate variance of $45 because it has paid a lower hourly rate ($5.40) than the standard hourly rate ($5.50). Note that both approaches—direct labor rate variance calculationand the alternative calculation—yield the same result. Labor yield variance arises when there is a variation in actual output from standard. Since this measures the performance of workers, it may be caused by worker deficiencies or by poor production methods. Labor mix variance is the difference between the actual mix of labor and standard mix, caused by hiring or training costs. We have demonstrated how important it is for managers to beaware not only of the cost of labor, but also of the differencesbetween budgeted labor costs and actual labor costs.

This awarenesshelps managers make decisions that protect the financial health oftheir companies. The labor efficiency variance calculation presented previouslyshows that 18,900 in actual hours worked is lower than the 21,000budgeted hours. Clearly, this is favorable since theactual hours worked was lower than the expected (budgeted)hours. A favorable labor rate variance suggests cost efficient employment of direct labor by the organization. Since rate variances generally arise as a result of how labor is used, production supervisors bear responsibility for seeing that labor price variances are kept under control.

This general fact should be kept in mind while assigning tasks to available work force. If the tasks that are not so complicated are assigned to very experienced workers, an unfavorable labor rate variance may be the result. The reason is that the highly experienced workers can generally be hired only at expensive wage rates. If, on the other hand, less experienced workers are assigned the complex tasks that require higher level of expertise, a favorable labor rate variance may occur. However, these workers may cause the quality issues due to lack of expertise and inflate the firm’s internal failure costs.

Insurance companies pay doctors according to a set schedule, so they set the labor standard. If the exam takes longer than expected, the doctor is not compensated for that extra time. Doctors know the standard and try to schedule accordingly so a variance does not exist. If anything, they try to produce a favorable variance by seeing more patients in a quicker time frame to maximize their compensation potential. Labor rate variance arises when labor is paid at a rate that differs from the standard wage rate. Labor efficiency variance arises when the actual hours worked vary from standard, resulting in a higher or lower standard time recorded for a given output.

Another element this company and others must consider is a direct labor time variance. Since the actual labor rate is lower than the standard rate, the variance is positive and thus favorable. Direct labor rate variance is very similar in concept to direct material price variance. The actual hours used can differ from the standard hours because of improved efficiencies which of the following is the formula to compute the direct labor rate variance in production, carelessness or inefficiencies in production, or poor estimation when creating the standard usage. Watch this video presenting an instructor walking through the steps involved in calculating direct labor variances to learn more. Hence, variance arises due to the difference between actual time worked and the total hours that should have been worked.