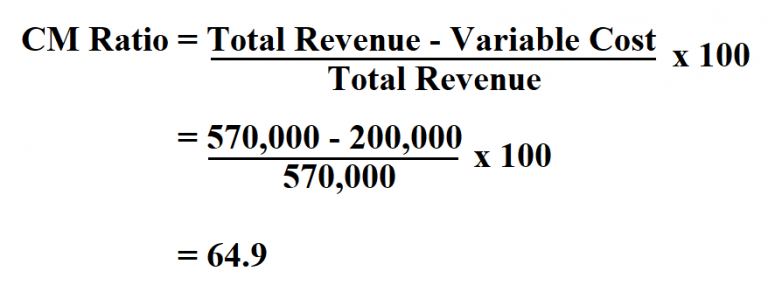

This, in turn, can help you make better informed pricing decisions, but break-even analysis won’t show how much you need to cover costs and make a profit. A higher contribution margin is usually better, and more money is available for fixed expenses. However, some companies may prefer to have a lower contribution margin.

- A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs.

- If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you.

- Selling products at the current price may no longer make sense, and if the contribution margin is very low, it may be worth discontinuing the product line altogether.

- To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit.

- You need to fill in the following inputs to calculate the contribution margin using this calculator.

Contribution Margin: Definition, Overview, and How To Calculate

The contribution margin is an important tool in cost and performance accounting, as it makes it possible to assess the profitability of individual products or services. A positive contribution margin means that the product or service not only covers the variable costs, but also contributes to covering the fixed costs. A negative contribution margin indicates that the product or service does not even cover the variable costs and is therefore not profitable. No, the contribution margin is not the same as the break-even point. Contribution margin 1 is the difference between the sales revenue and the variable costs of a product or service. Contribution margin 2 is calculated by deducting the area-specific fixed costs from CM1, i.e. the fixed costs that can be directly allocated to a specific product area or product group.

Fixed Cost vs. Variable Cost

Overall, the contribution margin plays a key role in understanding a company’s economic situation, making informed business decisions and ensuring long-term competitiveness. However, it may be best to avoid using a contribution margin by itself, particularly if you want to evaluate the financial health of your entire operation. Instead, consider using contribution margin as an element in a comprehensive financial analysis. Furthermore, a contribution margin tells you how much extra revenue you make by creating additional units after reaching your break-even point. Below is a breakdown of contribution margins in detail, including how to calculate them. 11 Financial is a registered investment adviser located in Lufkin, Texas.

What does a high or low Contribution Margin Ratio mean for a business?

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. One common misconception pertains to the difference between the CM and the gross margin (GM). Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. That means $130,000 of net sales, and the firm would be able to reach the break-even point.

Step 3 of 3

If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\).

Is Contribution Margin Higher Than Gross Margin?

Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative. This is because it would be quite challenging for your business to earn profits over the long-term. The contribution margin ratio is also known as the profit volume ratio. This is because it indicates the rate of profitability of your business. Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows. For instance, you can make a pricier version of a general product if you project that it’ll better use your limited resources given your fixed and variable costs.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Should the product be viewed as more of a “loss leader” or a “marketing” expense?

Such fixed costs are not considered in the contribution margin calculations. The contribution margin is a measurement through which we understand how much a company’s net sales will contribute to the fixed expenses and the net profit after covering the variable expenses. So, we deduct the total variable expenses from the net sales while calculating the contribution. One of the important pieces of this break-even analysis is the contribution margin, also called dollar contribution per unit. Analysts calculate the contribution margin by first finding the variable cost per unit sold and subtracting it from the selling price per unit.

The more customers she serves, the more food and beverages she must buy. These costs would be included when calculating the contribution accounts payable ledger definition format and posting margin. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin.